By Bloomberg News

Russian exporters are facing mounting liquidity challenges amid delays in receiving payments from foreign banks fearful of falling foul of US sanctions.

Click here to connect with us on WhatsApp

While companies aren’t missing payrolls and other obligations, daily spending is increasingly difficult to plan because of unpredictable cash flows, according to executives at five major commodities producers, speaking on condition of anonymity as the information is sensitive.

That’s adding to pressures on their cash reserves, the people said, particularly as overnight borrowing costs on domestic and foreign currencies have surged above 20% and there’s little or no availability of the yuan, the main foreign-exchange currency in Russia now.

Managing payments has become a time-consuming and manual process, with teams of employees calling international banks daily to explain why transactions aren’t in breach of sanctions, the executives said. Even so, payments sometimes take more than a month to process amid a constant risk of rejection, they said.

The US measures imposed in June sought to ramp up pressure on the Kremlin’s ability to fund its war in Ukraine by putting local banks in countries that trade with Russia at a higher risk of so-called secondary sanctions. That has delayed and disrupted payments to and from places like China and Turkey that have become key trading partners for Russia since the US and its Group of Seven allies imposed sweeping restrictions in response to the war.

The rising level of pain in Russia’s economy has caught the attention of President Vladimir Putin. The cross-border payment problem “is one of the serious challenges for us,” he told an Oct. 4 meeting of Russia’s Security Council.

“Payment problems have long been affecting the economy through increased transaction costs and increased ruble exchange rate volatility, which affects inflation expectations and inflation itself,” said Dmitry Polevoy, the investment director at Moscow-based Astra Asset Management. “Initially, importers had more problems, which supported the ruble, but difficulties for exporters threaten to increase pressure on the exchange rate.”

The Bank of Russia has hiked its key interest rate to 19% and warned of a possible further increase this month, amid a weakening ruble and persistent inflation that’s more than double its 4% target. The currency is slipping toward 100 per dollar after declining about 8% against the greenback so far this year.

“High transaction costs associated with restrictions on cross-border payments, as well as restrictions on export infrastructure” are among key challenges for Russia’s economy, Alexey Mordashov, billionaire owner of steelmaker Severstal, told a meeting of government and business officials this week.

“The issue is very acute and restrictions are growing,” Mordashov said. “I would like to ask the government to pay close attention to it.”

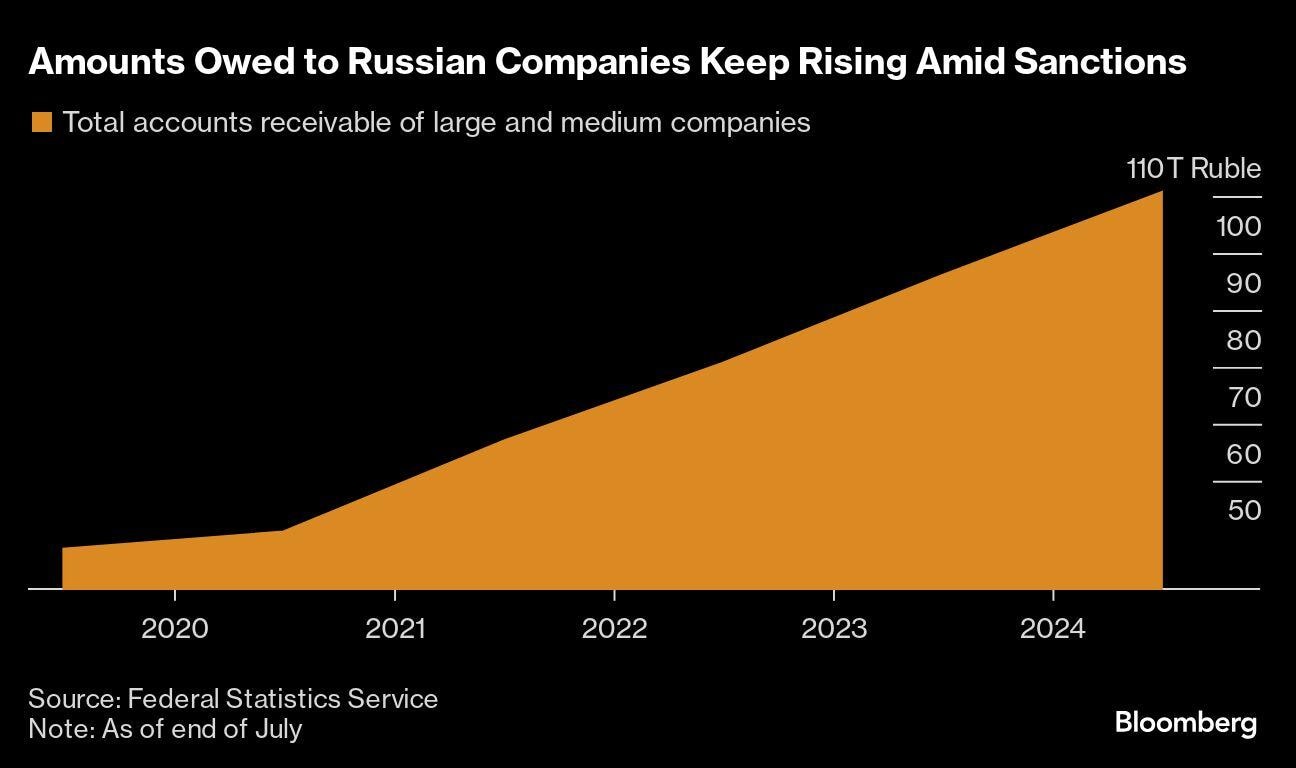

Other top exporters have acknowledged payment difficulties in financial statements. MMC Norilsk Nickel PJSC, Russia’s biggest miner, said its trade and other accounts receivable, the amount owed by customers, increased by more than $300 million in the first half of the year as a result of problems in trans-border payments. United Co. Rusal International PJSC, Russia’s top aluminum producer, reported that accounts receivable from third parties jumped 25%, or $307 million, in the same period.

The companies declined to comment on the situation for this story.

Some Russian companies have responded to the US restrictions by transferring deal settlements, including in yuan, to banks in neighboring countries such as Kazakhstan. Others have turned to cryptocurrency or even barter agreements to get paid.

As a result, top Russian exporters cut currency sales in Russia by 30% in September to just $8.3 billion as the ruble gained a larger role in settlements, according to central bank data published on Tuesday.

That’s contributed to a shortage of foreign currency liquidity inside Russia including in the yuan, which the central bank views as the main “friendly” currency in contrast to the “toxic” dollar and euro.

Russia has also switched much of its foreign trade into the ruble, which now accounts for 40% of its international operations, Putin said last month. The government is working to develop a payment system for use within the BRICS group of nations that may be presented when Putin hosts a summit of member states in Kazan this month.

Alex Isakov, Russia Economist

The difficulties with payments may impact investment activity in Russia, which increased by 9% in 2023 and is expected to grow by another 5% this year, said Oleg Kuzmin, an economist at Renaissance Capital in Moscow. “Next year, we expect investment growth rates to slow to 1.5%,” he said.

There’s no quick fix on the horizon. Exporters and importers will probably have to continue to look for payment options outside Russia, keeping part of their earnings abroad even as they’ll have to repatriate some of the money to comply with government requirements, Polevoy said.

© 2024 Bloomberg L.P.

First Published: Oct 11 2024 | 6:00 PM IST